Summary: During a speech at the Conservative Political Action Conference (CPAC) in Washington, DC, MicroStrategy co-founder Michael Saylor urged the United States to consider buying 20% of the Bitcoin supply as a strategic reserve. Saylor argued that this move would secure a dominant position for the country in the digital asset space, especially as other nations like China, Russia, and European countries increase their stake in cryptocurrency. He emphasized the benefits of a Bitcoin reserve, suggesting that it could help pay off the national debt and strengthen the dollar.

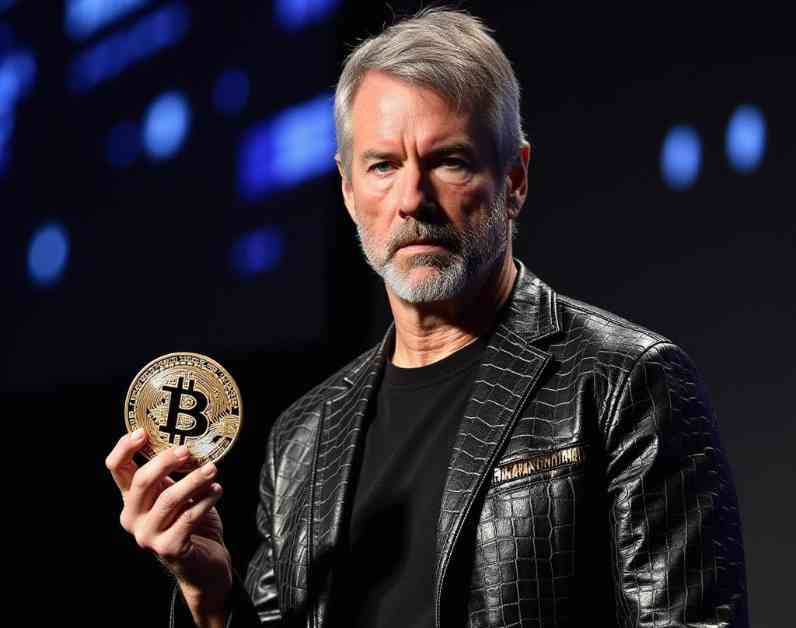

In a compelling address at the Conservative Political Action Conference (CPAC) in Washington, DC, Michael Saylor, the co-founder of MicroStrategy, made a bold call to action for the United States: purchase 20% of the Bitcoin supply as a strategic reserve. This strategic move, according to Saylor, would not only cement the country’s position in the digital asset realm but also potentially alleviate the mounting national debt. As nations like China, Russia, and various European countries ramp up their involvement in cryptocurrency, Saylor’s proposal sparks a crucial conversation about the future of financial reserves and the evolving landscape of global economies.

Saylor’s Case for a Bitcoin Reserve

During his address at CPAC, Saylor articulated a compelling case for why the United States should consider acquiring a significant stake in Bitcoin. By suggesting that the country purchase 20% of the Bitcoin supply, Saylor aims to position the US as a leader in the digital asset space, countering the increasing involvement of other nations. This strategic move, he argues, could not only bolster the nation’s financial security but also potentially address the mounting national debt—an issue that continues to loom large in economic discussions.

By proposing the acquisition of 20% of the Bitcoin supply, Saylor raises thought-provoking questions about the role of digital assets in national financial strategies. As the cryptocurrency landscape continues to evolve and gain prominence on the global stage, his proposal underscores the importance of forward-thinking approaches to economic security and stability. The potential benefits of a Bitcoin reserve, including the strengthening of the dollar and the ability to pay off national debt, add layers of complexity to the ongoing dialogue about the future of financial reserves and the role of emerging technologies in shaping economic landscapes.

The Future of Bitcoin: Saylor’s Vision and Predictions

Beyond advocating for a Bitcoin reserve, Saylor offered insights into the future trajectory of the cryptocurrency and its potential impact on financial markets. Drawing on his expertise as the co-founder of MicroStrategy, a company with a substantial Bitcoin portfolio, Saylor shared his vision for the long-term value of Bitcoin and predicted significant price increases in the coming years. By highlighting catalysts like the approval of spot Bitcoin ETFs, the involvement of banks in custody and lending against Bitcoin, and the integration of crypto into corporate balance sheets, Saylor painted a compelling picture of Bitcoin’s future as a dominant store of value and an inflation hedge.

Saylor’s projections for Bitcoin prices in the long run, including estimates of nearly £3.96 million per coin by the second half of 2024, underscore the transformative potential of cryptocurrency in reshaping traditional financial systems. With confidence in Bitcoin’s ability to surpass gold as a store of value and serve as a hedge against inflation, Saylor’s predictions offer a glimpse into a future where digital assets play a central role in global economic landscapes. His insights not only illuminate the potential growth of Bitcoin but also provoke thoughtful consideration of the evolving relationship between traditional financial assets and emerging technologies.