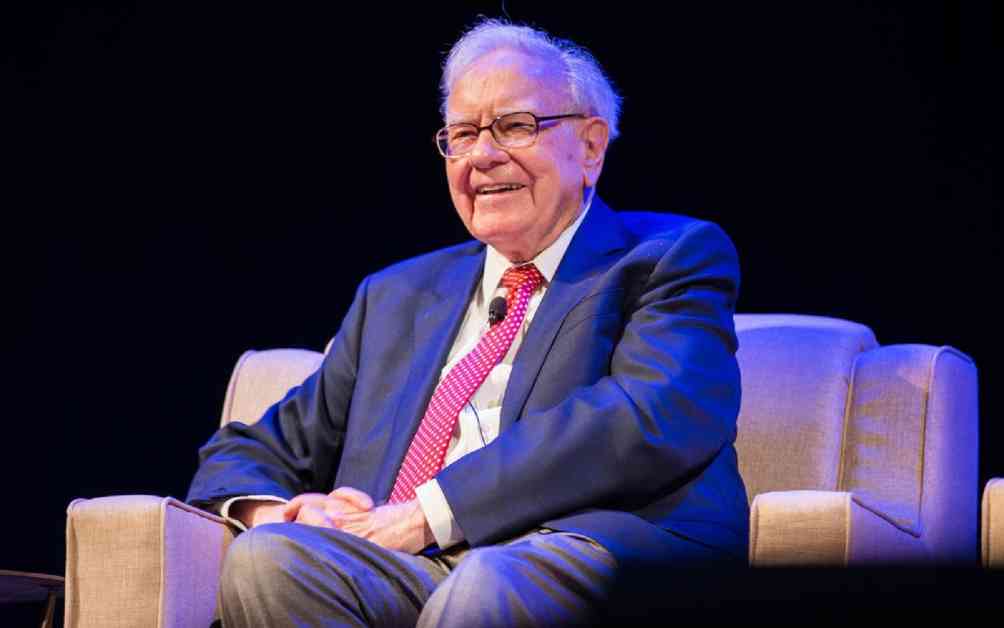

Renowned investor Warren Buffett has made headlines once again with Berkshire Hathaway’s recent investment in SiriusXM Holdings Inc. According to a Form 4 filing with the US Securities and Exchange Commission on February 2nd, Buffett’s company purchased over 2.3 million shares of SiriusXM, totaling a whopping £43.37 million. This move has propelled Berkshire Hathaway’s total ownership of SiriusXM to over 119.77 million shares, valued at an impressive £2.25 billion.

Berkshire Hathaway’s acquisition of SiriusXM shares took place through four trades starting on January 30th, coinciding with the day the radio satellite company released its Q4 results. SiriusXM Holdings Inc. is a prominent player in the audio entertainment industry, deriving its revenues primarily from the subscription service SiriusXM and the music streaming platform Pandora. With a combined monthly audience of nearly 160 million listeners, SiriusXM offers a diverse range of content to its 33 million subscribers, including news, exclusive interviews, live sports coverage, original shows, and on-demand podcasts. On the other hand, Pandora caters to over 5.8 million self-pay subscribers as SIRI’s audio streaming services platform.

SiriusXM’s Financial Performance and Strategic Focus

In the fourth quarter of 2024, SiriusXM reported revenues amounting to £1.76 billion. While the company’s full-year 2024 revenues hit £7 billion, it experienced a net loss of £1.67 billion. This net loss was attributed to a non-cash impairment charge of nearly £2.7 billion in Q3, stemming from an evaluation of the fair value of the company’s goodwill due to a sustained decline in SiriusXM’s share price, aligning with Liberty Media Corporation’s tracking stocks.

Despite the significant non-cash charge, SiriusXM management clarified that it does not affect the company’s cash flow, liquidity, or day-to-day operations. The company’s lower 2024 free cash flow of £816.86 million was linked to expenses related to Liberty Media transactions, elevated capital expenditures, and increased cash taxes. The merger with Liberty Media aims to streamline ownership structures and boost trading liquidity.

SiriusXM’s Future Outlook and Commitment to Shareholders

Looking ahead to 2025, SiriusXM has reaffirmed its full-year free cash flow guidance of £925.51 million and revenue projection of £6.84 billion. In Q4, the company distributed £74.04 million through dividends and initiated share buybacks towards the end of the year, completing £14.46 million in repurchases in December and January.

Throughout 2024, SiriusXM returned £321.91 million in dividends to shareholders, including payments to the previous parent company. Moving forward, the company is focusing on strategic capital allocation and aims to maintain a long-term leverage ratio in the low to mid 3’s range. Additionally, SiriusXM is optimistic about future opportunities in podcasting and advertising, aiming to achieve £160.95 million in annual savings by the close of 2025.

As with any investment decision, it is crucial to conduct thorough analysis or seek professional advice before diving into the market. Remember, investments come with inherent risks, and past performance is not a guarantee of future returns. So, tread carefully and make informed choices when navigating the financial landscape.