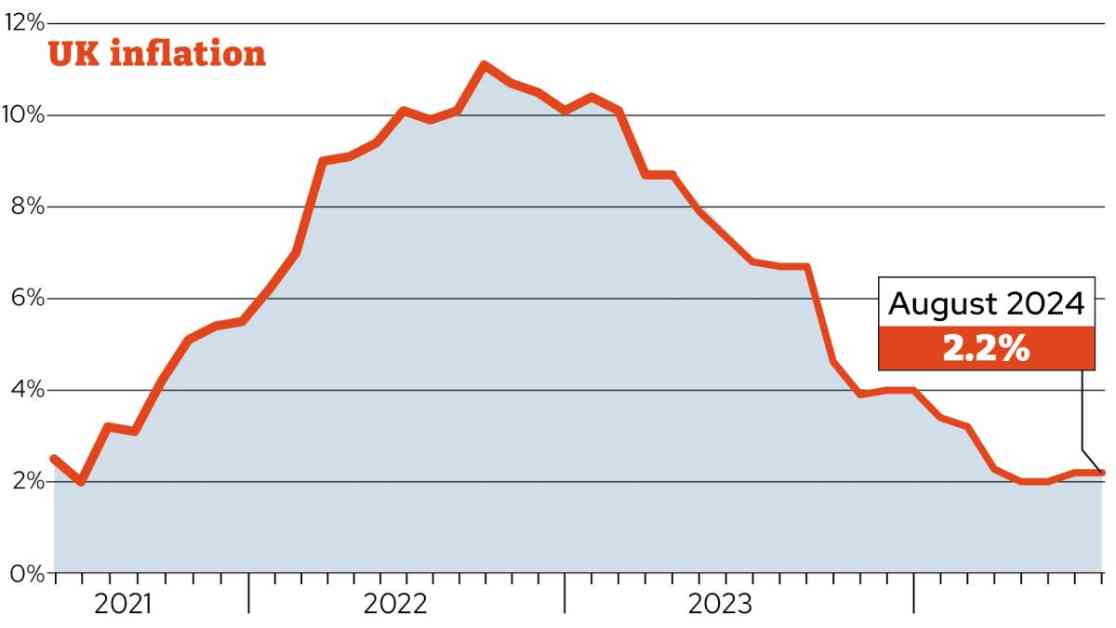

Inflation in the UK remained stable at 2.2% in August, according to data released by the Office for National Statistics (ONS). This figure was in line with expectations, as economists had predicted a slight increase. The Bank of England had forecasted a rise to around 2.4%, making the actual number slightly lower than anticipated. Core CPI, which excludes volatile measures such as energy, food, alcohol, and tobacco, saw a 12-month increase of 3.6% in August, up from 3.3% in July. Services inflation, which includes hospitality costs and air fares, rose to 5.6% from 5.2%. Notably, air fares surged by 22.2% between July and August, marking the second-largest increase since 2001.

Factors contributing to the stability of inflation included fluctuations in prices of air fares, offset by lower costs at petrol pumps and in restaurants and hotels. Additionally, shop-bought alcohol prices saw a slight decrease compared to the same period last year. Raw material prices fell due to lower crude oil prices, while the rate of increase in factory goods costs slowed down once again.

Grant Fitzner, chief economist at the ONS, explained that the various price movements in August had a balancing effect on inflation. He highlighted the significant rise in air fares, particularly to European destinations, which contrasted with the fall observed during the same period in the previous year. Fitzner also noted decreases in petrol prices, restaurant and hotel costs, and shop-bought alcohol prices.

Looking ahead to the remainder of 2024, economists have varied predictions for inflation rates. While most anticipate a further increase beyond the current 2.2%, the Bank of England’s forecast suggests a rise to 2.75% by the end of the year, with sustained high levels expected in the near future. Pantheon Macroeconomics foresees the headline rate peaking at 2.8% in November.

In terms of interest rates, the Bank of England typically adjusts rates in response to inflation nearing its 2% target. Following a recent cut from 5.25% to 5%, the Bank remains cautious about further reductions. Governor Andrew Bailey emphasized the need to maintain low inflation levels and exercise prudence in rate adjustments. Although some economists predict a possible rate cut in November or later, most do not foresee immediate changes following the latest inflation data.

The impact of inflation stability at 2.2% extends to various financial sectors, including mortgages, savings, and pensions. Mortgage rates, influenced by the Bank of England base rate, may respond to inflation trends, particularly affecting tracker and standard variable products. While fixed mortgage rates rely on long-term rate predictions, recent downward trends have led to reduced rates across the market, with some lenders offering competitive deals.

Savings rates, influenced by the Bank of England rate, have seen a decline in response to inflation trends. Despite this, there are still opportunities for savers to benefit from attractive rates, especially with the best easy-access and fixed-term accounts currently offering returns above inflation. Pensions, which have been impacted by the cost of living crisis, are also affected by inflation through annuity rates and state pension adjustments.

Annuities provide retirees with a guaranteed income stream, offering a secure alternative to depleting pension pots. While rising interest rates have improved annuity rates recently, potential future rate cuts due to inflation stabilization may impact the attractiveness of these products. Additionally, the state pension, governed by the triple lock policy, adjusts annually based on wage growth, inflation, or a minimum of 2.5%. With inflation currently lower than wage growth, the state pension’s incremental increase is expected to be moderate.

As the UK navigates the implications of inflation stability at 2.2%, individuals are advised to monitor changes in financial sectors and consider adjusting their strategies accordingly. Whether it’s reviewing mortgage options, maximizing savings returns, or planning for retirement income, staying informed about inflation trends and their impact is essential for making informed financial decisions.