Real estate has always been a popular choice for the wealthy when it comes to investing, thanks to its global demand, passive income, and lack of correlation to stock markets. However, not everyone has the capital to enter the real estate market. In recent years, the industry has evolved to include non-accredited investors through vehicles like real estate investment trusts (REITs). These trusts work like mutual funds, allowing investors to benefit from rental income and property appreciation without having to buy entire properties.

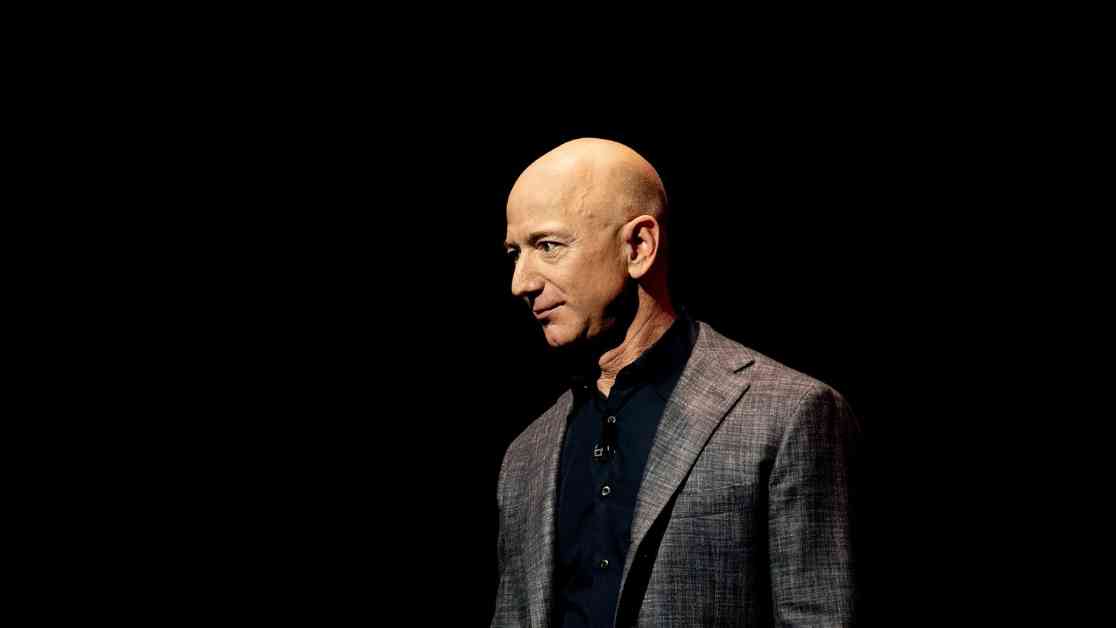

Online platforms for real estate investing have become increasingly popular, especially among millennials looking to access US markets. One such platform, Arrived, has caught the attention of big names like Jeff Bezos, Dara Khosrowshahi, and Marc Benioff. Arrived has over $177 million worth of real estate assets under management and offers opportunities to invest in single-family homes, vacation rentals, or real estate debt for as low as $100.

Investors can choose to invest in a single property or multiple properties through a fund structure. Arrived also offers a private real estate debt fund with an 8.1% annual dividend yield, where investors can finance real estate projects and earn interest payments. The platform boasts a historical annual dividend yield of 4.03% on single-family residential properties, generating nearly $1 million in annual rental income.

With over 670,000 registered users and almost $7 million paid back in dividends, Arrived has built a reputation for its stringent vetting process and data-driven approach to property selection. The platform’s investment committee, comprised of industry veterans, carefully analyzes properties for long-term growth potential and value creation. By bundling properties in a fund, Arrived is able to reduce costs for investors and improve overall economics.

While real estate investments are generally considered safe, liquidity can be a concern. Arrived addresses this issue by allowing investors to sell their REIT shares at any time, albeit with an exit load fee of up to 2%. It’s important to note that all investments carry risks, and past performance is not indicative of future returns. Before investing, individuals should conduct their own research or consult with a financial advisor.

In conclusion, real estate investing has become more accessible thanks to platforms like Arrived, offering opportunities for individuals to diversify their portfolios with tangible assets. With the backing of industry leaders and a track record of success, Arrived presents a compelling option for those looking to enter the real estate market with as little as $100.