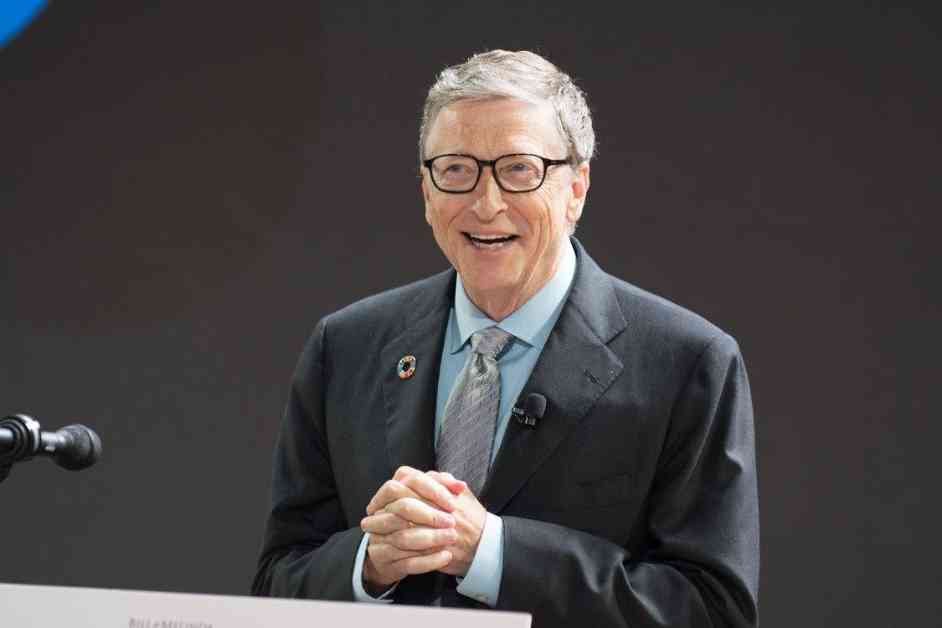

Bill Gates’ Tesla Short Sparks Bankruptcy Concerns

Microsoft co-founder Bill Gates, renowned for his environmental advocacy, finds himself in hot water over a controversial investment strategy. A revelation from Walter Isaacson’s 2023 biography of Elon Musk exposed Gates’ undisclosed short position against Tesla, a move that could potentially lead to financial ruin.

Short Position Unveiled

Gates’ bet against Tesla, a practice where investors profit from a company’s declining share prices, has recently come to light. This secretive maneuver reportedly resulted in a staggering $1.5 billion loss for Gates as Tesla’s stock soared by over 61% year-to-date and a jaw-dropping 1,578% over the past five years, closing at $400.99 on December 10th.

Gates vs. Musk: Clash of the Titans

Musk, never one to shy away from controversy, publicly criticized Gates for his short position in a scathing social media post. The Tesla CEO warned that if Tesla becomes the world’s most valuable company, Gates could face bankruptcy, as Tesla’s shares would need to surge by 200% to surpass Apple’s market cap.

Despite Differences, Mutual Admiration Persists

Interestingly, despite their financial clash, Gates has lauded Musk’s efforts in advancing sustainability. Even as Gates bet against Tesla, he publicly praised Musk’s innovative contributions to the environment and beyond. The dynamic between these two tech titans remains complex, showcasing a blend of rivalry and respect in the fast-paced world of business and innovation.

In the ever-evolving landscape of technology and finance, the Gates-Musk saga serves as a compelling reminder of the high-stakes nature of investing and the unpredictable twists that can shape the fortunes of even the most prominent figures. As Gates and Musk navigate this tumultuous terrain, their interactions offer a glimpse into the intricate dance of power, ambition, and vision that defines the realm of tech giants.