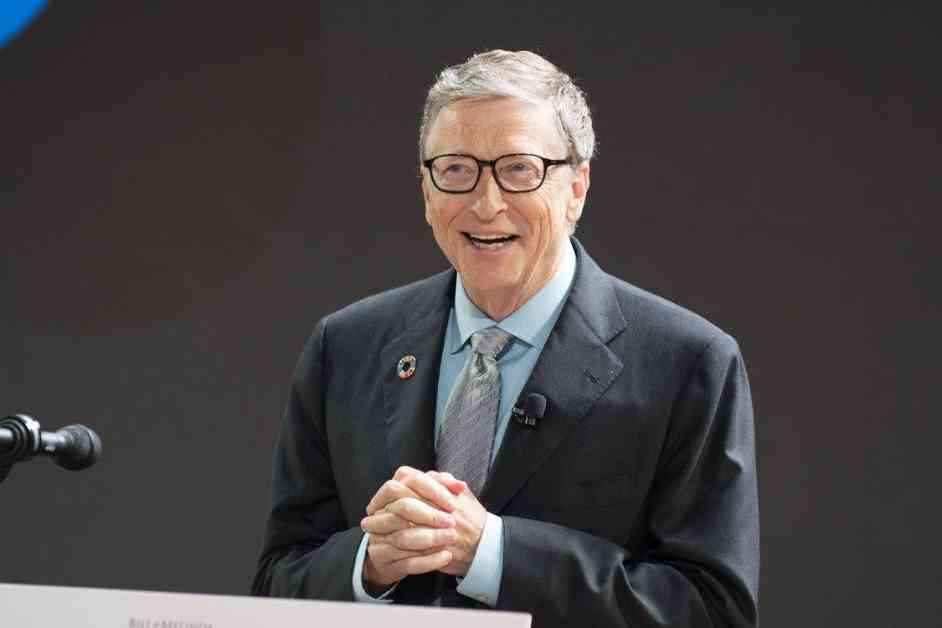

The Gates Foundation, according to a 13f filing with the US Securities and Exchange Commission, decided to offload 2.48 million Class B shares of Berkshire Hathaway in Q1. This move was worth a whopping £939.89 million ($1.25 billion) based on the closing price of £381.47 ($507.33) per share on 15th May. This latest sale marks the third consecutive quarter that the Gates Foundation has trimmed its stake in the company of his long-time friend Warren Buffett. In total, Gates has sold over 7 million shares of the company in the past three quarters but still holds 17.17 million Class B shares of Berkshire Hathaway worth £6.88 billion ($9.15 billion).

A Potential Rift in a Decades-old Friendship

Gates and Buffett’s friendship of over three decades might have strained in recent years. Gates joined Berkshire Hathaway’s board in 2004 until 2020, and Buffett served as a member of the Bill and Melinda Gates Foundation until 2021, shortly after the couple announced their divorce. In 2006, Buffett pledged to give away 85% of his stake in Berkshire Hathaway to charity, most of which was supposed to go to Gates’ foundation. However, in a 2024 interview with The Wall Street Journal, Buffett revealed that the donations to Gates’ foundation would stop after he passes away.

A $100 Million Stake in a Pharma Company

During the quarter ended 31st March, Gates opened a new position in West Pharmaceutical Services by buying 444,500 shares of the pharma company for £74.82 million ($99.51 million). While most analysts have a ‘Buy’ rating on the stock with a 12-month stock price target of up to £300.77 ($400) per share, the company is currently navigating a class action lawsuit alleging that management failed to adequately disclose adverse facts about business prospects and operations. This led to investor losses after the company issued disappointing revenue and earnings forecasts for 2025 in early February, causing the stock price to nosedive by almost 40%.

Overall, it seems like the Gates Foundation is making some interesting moves in the stock market, selling off shares of Berkshire Hathaway while investing in a pharma company. Not really sure why this matters, but it’s definitely something to keep an eye on. Who knows what the future holds for these investments? Maybe it’s just me, but I feel like there’s more to this story than meets the eye. As always, remember that investments are subject to market risks, and past performance doesn’t indicate future returns. It’s a wild world out there, folks.