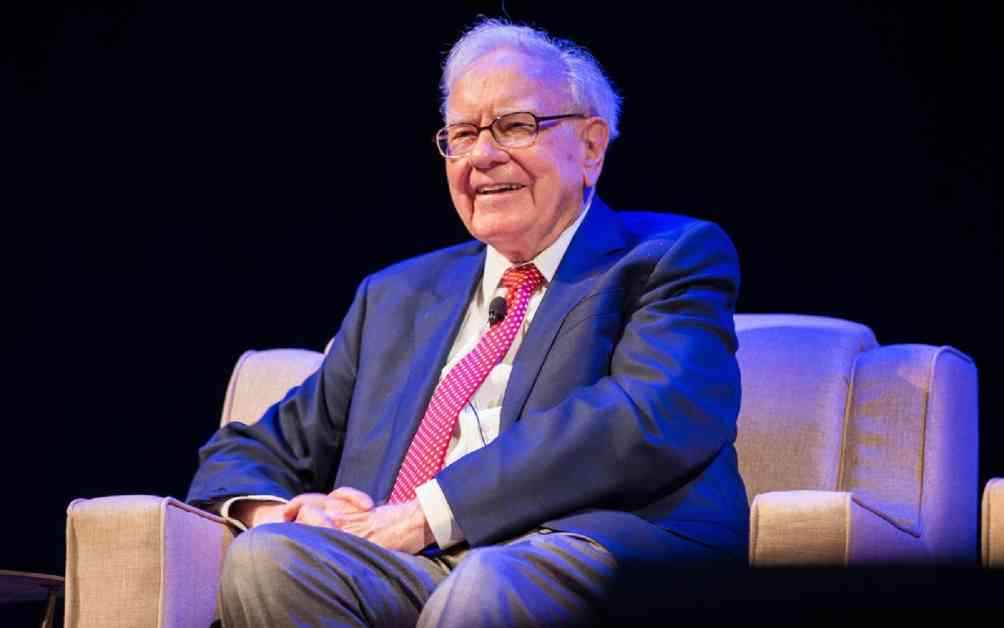

Warren Buffett, the billionaire investor, shook things up in the banking industry with Berkshire Hathaway’s heavy selling of banking shares in Q1, as per a 13f filing with the US Securities and Exchange Commission. The Oracle of Omaha made a surprising move by selling off all shares of Brazilian bank Nu Holdings, which has its very own crypto platform. During the quarter that ended on March 31st, he got rid of a whopping 40.18 million shares of the bank, valued at £396 million ($527 million) based on the closing price of £9.87 ($13.13) on May 15th.

Nu Holdings had received a substantial investment of £375.74 million ($500 million) from Berkshire Hathaway during its 2021 Series G funding round, followed by an additional £187.87 million ($250 million) capital injection. However, Buffett’s recent actions might suggest that he is holding his ground on his stance regarding cryptocurrencies and related services, as he famously referred to Bitcoin as ‘rat poison squared.’ Despite Nu Holdings launching its Nubank Cripto platform to support crypto transactions and digital token conversion, Buffett remains skeptical about the future of digital tokens, forecasting a ‘bad ending’ for the industry.

On another note, Buffett decided to part ways with his stake in Citigroup by selling off his entire holding of 14.64 million shares during the quarter. This move would be valued at an impressive £841.66 million ($1.12 billion) based on the closing price of £57.08 ($75.96) per share on May 15th. Citigroup has been facing numerous operational and regulatory challenges in recent years, including costly accounting errors and hefty fines amounting to millions of dollars. The bank has been under scrutiny for various compliance failures over the past decade, leading to penalties totaling £1.12 billion ($1.5 billion) paid to US regulators.

Furthermore, Berkshire Hathaway also decided to reduce its stake in Bank of America by 7.15%, selling off 48.66 million shares, worth £1.61 billion ($2.15 billion) based on the closing price of £33.35 ($44.38) per share on May 15th. Despite this sell-off, Buffett’s company still holds a significant 631.57 million shares of the bank, valued at £18.80 billion ($26.36 billion). Bank of America has been grappling with its fair share of regulatory challenges and system glitches, causing widespread outages and account access issues for its customers. Last year, the bank agreed to implement remedial actions following a settlement with the Office of the Comptroller of the Currency, addressing deficiencies in its sanctions compliance and suspicious activity monitoring systems.

In essence, Buffett’s recent decisions to offload banking shares seem to be a strategic move to steer clear of companies facing prolonged systemic and regulatory challenges, despite their strong financial positions. These moves reflect his intent to mitigate risks in a volatile market environment, showcasing his prudent approach to investment decisions. While the banking sector continues to navigate through turbulent waters, Buffett’s actions provide valuable insights into his investment philosophy and risk management strategies in uncertain times.