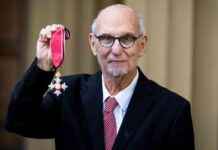

A small Kansas bank’s CEO was sentenced to over 24 years in prison for his involvement in a cryptocurrency scam that caused the bank to collapse and be taken over by the Federal Deposit Insurance Corporation.

Shan Hanes, the CEO of Heartland Tri-State Bank, is facing charges of embezzling $47 million. According to federal prosecutors, he fell victim to a “pig butchering” scam and transferred the stolen funds to cryptocurrency wallets managed by the scammers. The scheme exploited his greed and financial vulnerabilities.

Hanes, 53, massively embezzled in a series of wire transfers over just eight weeks last year, leading to the collapse and FDIC takeover of Heartland Tri-State Bank in Elkhart, one of only five U.S. banks that failed in 2023. He defrauded a local church, an investment club, and his daughter’s college savings account. According to court records from the U.S. District Court in Wichita, Kansas, the scammers convinced him to transfer more funds to unlock supposed returns on his cryptocurrency investments.

### Court Delivers Verdict In Shan’s Case

Despite transferring significant funds, Hanes never profited from his actions and lost all the stolen money. On Monday, Judge John Broomes sentenced Hanes to 293 months in prison. The sentence exceeded the prosecution’s recommendation of 264 months, which was made after Hanes admitted guilt to one count of embezzlement by a bank officer in May.

During the sentencing hearing, Brian Mitchell, a longtime neighbor of Hanes in Elkhart, Kansas, described his actions as “pure evil.” Mitchell, a shareholder in Heartland Tri-State, said that around 30 fellow shareholders attended Hanes’ sentencing more than a year after the bank’s collapse wiped out their investments.

“There were people who lost 70, 80 percent of their retirement” due to Hanes’ actions, Mitchell told CNBC in a phone interview on Wednesday. According to Mitchell, one local woman is struggling to afford a nursing home for her 93-year-old mother, while another woman has been forced to delay her retirement due to the crime.

Mitchell, who was not a shareholder but who was a member of the investment club victimized by the CEO, said that Hanes showed little, if any, remorse for his actions despite hearing victims describe the devastating impact of his crime in court.

“Shan was facing the judge, and he just looked over his left shoulder for a second, and didn’t make eye contact, and said, ‘Sorry,'” Mitchell said, describing the scene in the courtroom. “And that was it.” According to Mitchell, Hanes appeared to be in a state of “absolute shock” when Broomes imposed the harsh sentence and ordered his immediate arrest.

### How Pig Butchering Scams Work

Prosecutors and bank regulators stated that Hanes, a father of three daughters, began embezzling funds after falling victim to a pig-butchering scam in late 2022. The court filing described the scheme, stating, “a scammer convincing a victim (a pig) to invest in supposedly legitimate virtual currency investment opportunities and then steals the victim’s money — butchering the pig.”

In February, a 37-year-old woman named Shreya Datta fell victim to a cryptocurrency romance scam that employed deepfake technology. The scammers manipulated her emotions and financial information, leading to significant financial loss and debt.

Researchers warn that pig butchering scams are on the rise, often beginning with a seemingly innocent wrong-number text message. These scams have been particularly effective in targeting cryptocurrency investors, with criminals stealing at least $75.3 billion in cryptocurrencies in recent years, according to a study published this year by researchers at The University of Texas at Austin.

### Impact on Community and Victims

The fallout from Shan Hanes’ actions has had a profound impact on the community of Elkhart and the victims who trusted him with their finances. Many individuals and organizations have been left financially devastated by the collapse of Heartland Tri-State Bank and the subsequent loss of their investments.

One victim, who wished to remain anonymous, shared their story of how they had entrusted their life savings to Hanes, only to have it all disappear in the blink of an eye. “I thought I was making a wise investment for my retirement, but now I have nothing left. It’s heartbreaking to see how one person’s greed can destroy so many lives,” they said.

The local church that was defrauded by Hanes is now struggling to make ends meet, as their funds were wiped out in the cryptocurrency scam. Without the financial support they had relied on from the bank, they are facing difficult decisions about how to continue their operations and serve their community.

### Lessons Learned and Moving Forward

The case of Shan Hanes serves as a cautionary tale about the dangers of cryptocurrency scams and the importance of due diligence when investing in financial opportunities. It highlights the need for increased regulation and oversight in the cryptocurrency market to protect investors from falling victim to fraudulent schemes.

Moving forward, it is essential for individuals and organizations to conduct thorough research and verify the legitimacy of any investment opportunity before committing their funds. By staying informed and vigilant, investors can protect themselves from becoming victims of financial fraud and avoid the devastating consequences that come with it.

In the aftermath of the Heartland Tri-State Bank collapse, the community of Elkhart is coming together to support one another and rebuild trust in the local financial system. While the scars left by Shan Hanes’ actions may take time to heal, the resilience and solidarity of the community are shining through as they work towards a brighter future.

As the dust settles on this tragic chapter in Elkhart’s history, one thing is clear: the lessons learned from this experience will serve as a reminder of the importance of transparency, accountability, and integrity in the financial industry. Only by upholding these principles can we ensure that similar tragedies are prevented in the future.