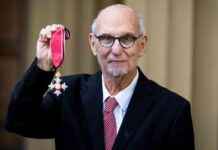

Robert Herjavec, the well-known investor from Shark Tank, is famous for giving straightforward and honest advice. When discussing the idea of starting a business that doesn’t require much time but can still be profitable, his response was surprising: “Don’t get into business.” This statement wasn’t meant to discourage aspiring entrepreneurs but to highlight the fact that even seemingly easy business ventures demand a lot of time, effort, and financial investment. In a recent YouTube video from his series, 20 Questions Billionaires Get Asked Every Day, Herjavec provided a reality check for those looking for quick and effortless success in business.

In the video, Herjavec shared a conversation where someone asked him to recommend a business that could make good money without needing a lot of time. His response of “Don’t get into business” was unexpected but insightful. He explained that even businesses that seem low-maintenance initially require a significant amount of effort at the start. “Even easy businesses that you think won’t require a lot of hands-on work… guess what? In the beginning, they will all take up your time,” he emphasized. Herjavec stressed that this is the nature of entrepreneurship – it requires both a financial investment and a strong dedication.

He pointed out that all businesses, even those perceived as easy, will consume your time and money in the beginning stages. He warned against the misconception of easy business ventures, noting that building a successful operation often takes years of hard work. “Business is just hard. It takes many years to get to easy,” Herjavec concluded, advising people to enter the business world with realistic expectations and a willingness to persevere.

While Herjavec advocates for the hard work and dedication required in entrepreneurship, his fellow Shark Tank investor, Mark Cuban, offers a different perspective – building wealth through passive income. Cuban’s strategy involves investments and income-generating activities that require less hands-on effort, providing an alternative view on achieving financial success.

Cuban suggests seven ways to make money while you sleep, including investing in dividend-paying companies, diversifying with the S&P 500, opting for low-cost mutual funds, utilizing high-yield savings accounts, exploring fractional real estate investments, engaging in peer-to-peer lending, and monetizing personal passions. These strategies offer opportunities for passive income generation without the need for constant hands-on involvement.

The contrasting viewpoints of Herjavec and Cuban showcase the different paths to financial independence. While Herjavec emphasizes the hard work and dedication needed for active entrepreneurship, Cuban’s approach highlights the potential of passive income strategies. Both perspectives underscore the importance of persistence, smart investments, and a clear understanding of financial goals in achieving lasting wealth. Combining elements of both approaches could provide a balanced roadmap to financial success.