Billionaire investors and renowned hedge fund managers, such as Pershing Square Capital Management’s Bill Ackman, Citadel’s Ken Griffin, and Susquehanna International Group co-founder Jeff Yass, made significant moves in the second quarter of the year by acquiring millions of shares in Nike. This move comes at a time when the athletic giant is facing challenges in retaining its top market spot, with its shares plummeting over 20% year-to-date and more than 50% since mid-2021 to hover around $86 apiece. The company’s profit margins have notably declined due to stiff competition from emerging brands like Hoka and Skechers, a lack of product innovation, and the decision to prioritize direct-to-consumer channels over longstanding distribution agreements with key vendors like Foot Locker under CEO John Donahoe.

Despite these struggles, there is a glimmer of hope for Nike as it recently announced the appointment of Elliott Hill as its new CEO, replacing Donahoe next month. Hill, a 32-year veteran of the company and former president of Nike’s consumer marketplace business, is set to bring a fresh perspective to the table. The news of Hill’s appointment drove Nike’s stock price up by over 6.8% on September 20, signaling a renewed sense of optimism among investors.

Hill, who started as an intern at Nike in 1988 before rising through the ranks to become president in 2020, is well-regarded for his in-depth understanding of industry partners, leadership qualities, and passion for sports and products. The Nike board believes that Hill is the right person to lead the company towards a path of innovation and rebuilding relationships with industry vendors. This announcement comes just before the company’s investor day on November 19, where management is expected to provide a revised outlook on financial guidance under Hill’s leadership.

Analysts from top brokerages have responded positively to Hill’s appointment, with many raising their target price for Nike’s stock. They believe that Hill’s return will serve as a catalyst for the company’s long-term earnings prospects and positively impact its market share. Hill’s reputation as a product-centric leader who is well-liked internally and popular with retail partners bodes well for Nike’s future growth trajectory.

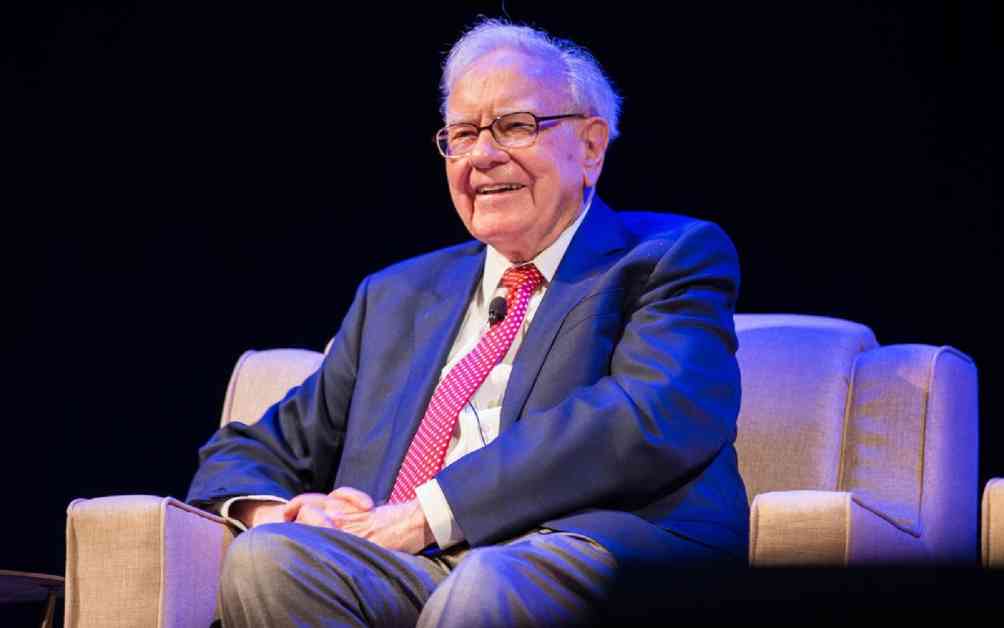

While Hill’s appointment has sparked optimism among investors, Warren Buffett, chairman of Berkshire Hathaway, has notably refrained from investing in Nike stock despite its impressive returns over the years. Buffett, known for his selective approach to investing in valuable companies at reasonable prices, has expressed a need for more clarity and confidence in Nike’s competitive advantages before considering it as a potential investment.

Buffett’s investment philosophy revolves around identifying simple businesses with clear growth prospects, a criteria that Nike may not fully meet in his eyes. The complexities within Nike’s vast empire and the intrinsic risks associated with the sports equipment industry may pose challenges for Buffett in evaluating the company’s long-term prospects with a high level of certainty. As Nike continues to reposition its marketing and product strategies under Hill’s leadership, Buffett remains cautious about the company’s suitability as an investable asset.

In conclusion, the appointment of Elliott Hill as Nike’s new CEO has injected a sense of optimism into the company’s future prospects. With billionaire investors like Bill Ackman and Ken Griffin showing confidence in the brand, Nike may be on the cusp of a turnaround under Hill’s leadership. However, the road ahead is not without its challenges, and it remains to be seen how Hill will navigate the complexities of the industry to drive sustainable growth for Nike in the long run.